Investing your money wisely is one of the best ways to secure your financial future, and two popular investment options that often come up in discussions are SIP (Systematic Investment Plan) and FD (Fixed Deposit). Both of these financial products come with their own set of benefits, risks, and returns, but the choice between them depends on your financial goals, risk tolerance, and investment horizon.

As we step into 2025, the investment landscape is evolving with changing economic conditions, inflation rates, and interest rates. So, let’s dive into what makes each of these investment avenues unique and which one might be better suited for you this year.

What is SIP (Systematic Investment Plan)?

SIP is a method of investing in mutual funds where you invest a fixed amount of money at regular intervals, usually monthly. It allows you to enter the equity market without having to time it perfectly, as your money is spread over time. SIPs are known for their ability to average out the cost of investment (through rupee cost averaging) and provide compounded growth over time.

In recent years, SIPs have gained popularity as they offer:

- Flexibility: You can start with as low as ₹500 per month, and increase or decrease the amount as per your financial situation.

- Long-Term Growth: Mutual funds, especially equity mutual funds, have historically outperformed other investment options in the long run.

- Diversification: SIPs invest in a variety of stocks and bonds, which helps spread risk.

- Compounding Benefits: The returns from SIPs grow over time, benefiting from the magic of compounding.

What is FD (Fixed Deposit)?

FDs, on the other hand, are a traditional, low-risk investment option where you deposit a lump sum amount with a bank or financial institution for a fixed tenure. The interest rate is predetermined, and you receive returns either monthly, quarterly, or at the end of the term. The principal amount is safe, and the returns are guaranteed, which is why FDs are often seen as a safer alternative to more volatile investments.

The key features of FDs include:

- Safety: Your principal is protected, making it ideal for risk-averse investors.

- Predictable Returns: The interest rate is fixed, so you know exactly what you will earn by the end of the term.

- Short to Medium-Term Investment: FDs are often used by those who need guaranteed returns in the short term, such as for meeting specific financial goals in the next 1-5 years.

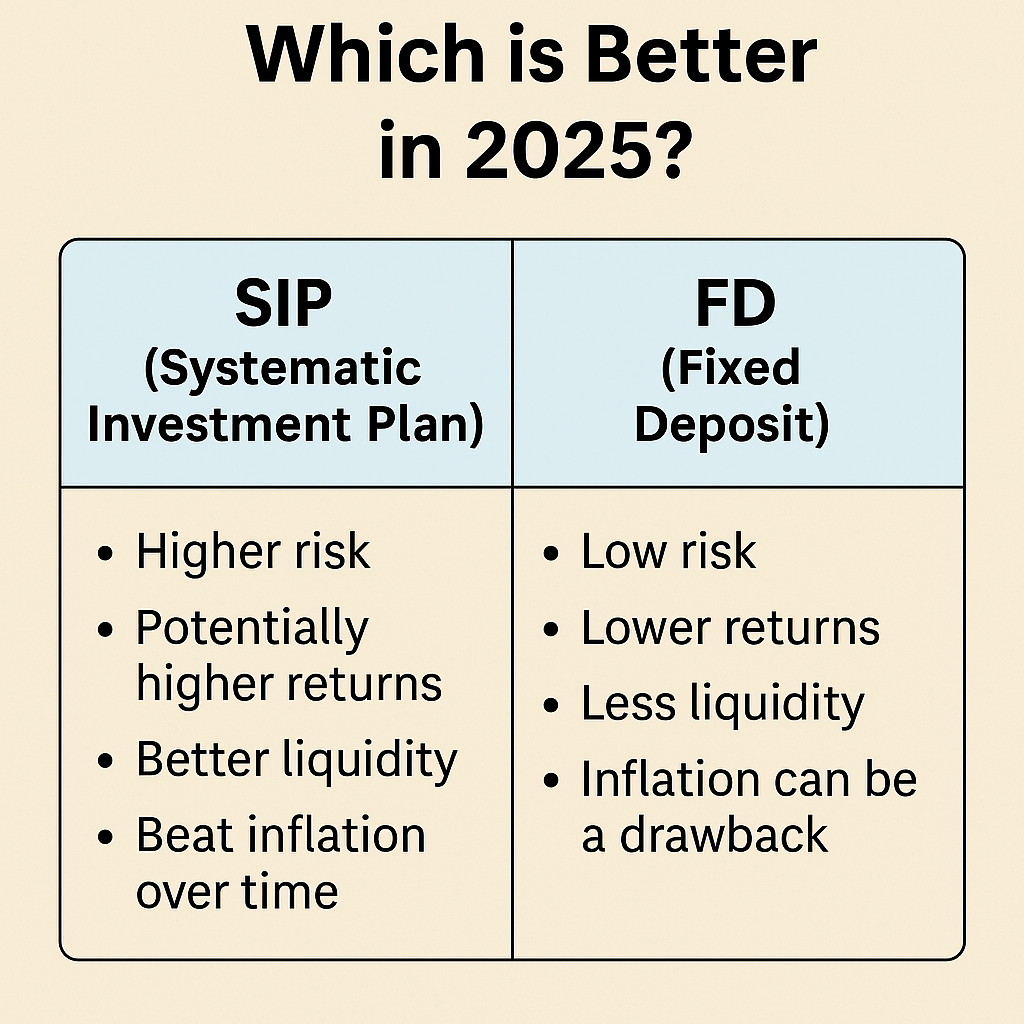

SIP vs FD: Which One is Right for You in 2025?

When deciding between SIP and FD, consider the following factors:

1. Risk Appetite:

- SIP: Since SIPs involve investing in equity or debt mutual funds, they come with a higher risk. The value of your investment can fluctuate based on market conditions. However, the longer you invest, the better the potential for growth, as markets tend to rise over time.

- FD: FDs are low-risk investments as they provide guaranteed returns, making them perfect for risk-averse investors or those looking to protect their capital.

2. Returns:

- SIP: Historically, mutual funds have outperformed traditional investment products like FDs. Over long periods, equity mutual funds have delivered returns in the range of 10%-15% per annum. This means SIPs can offer significantly higher returns than FDs, especially if you stay invested for the long term.

- FD: The returns on FDs are typically lower, often in the range of 5%-7% per annum in 2025, depending on the bank and tenure. Although safe, FDs fail to keep up with inflation, which means your money could lose value over time in real terms.

3. Liquidity:

- SIP: Mutual funds have better liquidity compared to FDs. You can redeem your SIP units whenever you need, though you may incur capital gains tax if you redeem them within 3 years. However, many people prefer SIPs for long-term goals.

- FD: FDs have a fixed tenure, and breaking them before maturity often incurs a penalty and results in lower interest. While FDs are less flexible, they offer a predictable return, which appeals to people with specific short-term goals.

4. Inflation:

- SIP: Inflation can erode the real value of your returns if you’re not careful. However, SIPs in equity funds are better equipped to beat inflation over time due to their growth potential.

- FD: Inflation can be a major drawback for FDs. With the returns being fixed and often lower than inflation rates, your money might not grow enough to keep up with rising prices, reducing your purchasing power in the long term.

5. Taxation:

- SIP: Mutual funds are subject to capital gains tax, with short-term capital gains (less than 3 years) taxed at 15% and long-term capital gains above ₹1 lakh taxed at 10%. However, equity-linked savings schemes (ELSS) can offer tax benefits under Section 80C.

- FD: The interest earned on FDs is taxable according to your income tax slab. Additionally, TDS (Tax Deducted at Source) is applicable if your interest income exceeds ₹40,000 (₹50,000 for senior citizens).

Conclusion: Which is Better in 2025?

As we move into 2025, both SIPs and FDs have their place in a diversified investment portfolio. Here’s a quick recap to help you decide:

- Choose SIP if: You’re looking for long-term wealth creation, can tolerate market fluctuations, and want to beat inflation. SIPs are best suited for investors with a higher risk appetite who want to benefit from equity market growth.

- Choose FD if: You’re risk-averse, prefer guaranteed returns, or have short to medium-term goals. FDs are ideal if you need a safe investment option to park your money without worrying about market volatility.

In the end, the choice between SIP and FD boils down to your financial goals, risk tolerance, and investment horizon. If you’re still unsure, you might even consider a combination of both—using SIPs for long-term growth and FDs for short-term safety. Whatever you choose, remember to assess your financial situation and seek advice from a financial expert before making your final decision.